Are you feeling stuck trying to find car insurance? Maybe a past mistake is making things difficult, or perhaps you only need coverage for a single day. It can feel like traditional insurance policies are designed for everyone but you. Many drivers think that finding affordable coverage after a DUI or getting a policy for just a weekend is impossible. They worry that one mistake or an unusual need will cost them a fortune.

We are here to tell you that there is a solution. You can find affordable, specialized car insurance that fits your exact needs. Whether you need to file an SR-22, get back on the road after an accident, or just insure a car for a short trip, the right policy is out there. You just need to know where to look.

This guide will walk you through everything. We will explain SR-22 and DUI insurance in simple terms. We will show you how to find cheap temporary and even one-day car insurance. By the end of this article, you will have the knowledge and confidence to secure the perfect coverage without breaking the bank.

What is SR22 Insurance and Why Might You Need It?

Let’s clear up a common myth right away. SR-22 is not a type of insurance. It is a certificate that your insurance company files with the state. This form proves that you have at least the minimum amount of liability car insurance required by law. Think of it as a guarantee to the state that you are a responsible driver.

Most people who need an SR-22 have been ordered to get one by a court or their state’s Department of Motor Vehicles (DMV). Common reasons for this requirement include:

- Driving Under the Influence (DUI): A conviction for driving while intoxicated is a frequent trigger.

- Driving Without Insurance: If you are caught driving without the legally required coverage.

- Serious Accidents: Causing an accident that results in significant injury or damage, especially if you were uninsured.

- Multiple Traffic Offences: Accumulating too many traffic tickets in a short period.

The SR-22 certificate is linked directly to your auto insurance policy. If you cancel your policy or let it lapse, your insurance company is required to notify the state immediately. This notification, often called an SR-26, will likely result in the suspension of your driver’s license.

How to Find Cheap Car Insurance SR22

Finding cheap car insurance SR22 can feel challenging, but it is not impossible. The key is to shop around and compare quotes from different providers. Not all insurance companies offer SR-22 filings, and those that do have very different rates.

Here are the steps to find affordable coverage:

- Contact Your Current Insurer: Start with your existing insurance company. Ask them if they file SR-22 forms. If they do, they can add it to your current policy. However, be prepared for your rates to increase.

- Shop for a New Policy: If your current insurer does not offer SR-22s or if their new rate is too high, you need to look for a new provider. Many companies specialize in high-risk policies and can provide competitive rates.

- Specify Your Needs: When getting quotes, be upfront about needing an SR-22. This ensures you get an accurate price and that the company can fulfil the state’s requirement.

- Focus on Liability: To keep costs down, consider a cheap car insurance policy that covers liability only. This covers damages to others but not to your vehicle. If your car is older and not worth much, this can be a smart way to save money while meeting your legal obligations.

Navigating Specialized Car Insurance with a DUI

A DUI is a serious offence that can dramatically impact your car insurance rates. Insurance companies view drivers with a DUI on their record as high-risk. This means they are more likely to be involved in a future accident, leading to higher premiums. Finding cheap car insurance with a DUI requires patience and strategic shopping.

Why Does a DUI Increase Insurance Costs?

After a DUI, insurers see you as a greater financial risk. The statistics show that drivers with a DUI are more likely to file a claim. To offset this risk, companies increase their rates. Furthermore, a DUI conviction often comes with a state requirement to file an SR-22, which adds to the overall cost. Your goal is to find affordable car insurance for DUI drivers that still provides adequate protection.

Finding Affordable Coverage After an Accident or DUI

If you are looking for cheap full coverage car insurance with an accident or a DUI on your record, you will need to be proactive. Full coverage includes liability, collision, and comprehensive insurance. Collision coverage pays for damage to your car from an accident. In contrast, comprehensive coverage pays for theft or damage from other events like hail or vandalism.

Here is how to find the best rates:

- Ask for Discounts: Even high-risk policies can be eligible for discounts. Ask about good student discounts, safe driver courses, or discounts for bundling with renters’ or home insurance.

- Increase Your Deductible: Your deductible is the amount you pay out of pocket before your insurance covers the rest. A higher deductible usually means a lower monthly premium.

- Improve Your Credit Score: Many insurers use your credit score to help determine your rates. Paying bills on time can improve your score and lower your insurance costs over time.

- Choose the Right Vehicle: The type of car you drive affects your insurance rates. A less expensive, safer car will be cheaper to insure than a high-performance sports car.

Temporary and Short-Term Car Insurance Solutions

Sometimes, you do not need an annual insurance policy. You might be borrowing a friend’s car for a road trip, or maybe you only need a car for a week while yours is in the shop. In these cases, temporary insurance is the perfect solution.

What is Temporary Car Insurance?

Temporary or short-term car insurance provides coverage for a limited period. This can range from a single day to several months. It offers the same types of protection as a standard policy, including liability, collision, and comprehensive coverage. Finding cheap temporary car insurance is ideal for situations like:

- Borrowing a car from a friend or family member.

- Renting a car (though rental companies offer their insurance).

- Driving a newly purchased car home from the dealership.

- I need coverage while visiting from another country.

How to Get Cheap One-Day Car Insurance

If you only need coverage for 24 hours, consider cheap one-day car insurance. Many mainstream insurance companies do not offer policies for such a short period. However, specialized providers focus specifically on these products.

The best way to get cheap 3-day car insurance or even coverage for a week is to search for companies that offer cheap short-term car insurance. These policies are designed to be flexible and affordable. You can often buy cheap same-day car insurance with no waiting period online in just a few minutes. This convenience is perfect for last-minute needs.

When looking for cheap temporary car insurance, be sure to read the policy details carefully. Understand the coverage limits and any exclusions that may apply. Whether you need cheap day-to-day car insurance or cheap weekly car insurance, comparing quotes from a few different speciality providers is the best way to find a great deal.

Understanding Liability-Only Car Insurance

Suppose your top priority is to meet the legal driving requirements at the lowest possible cost. In that case, a liability-only policy might be the right choice for you.

What Does Liability-Only Insurance Cover?

Liability insurance covers costs for injuries and property damage you cause to others in an accident. It is broken down into two main parts:

- Bodily Injury Liability: This pays for the medical expenses of other people if you are at fault in an accident.

- Property Damage Liability: This pays for repairs to other people’s property, such as their car, that you damage in an accident.

It is essential to understand what liability insurance does not cover. It does not pay for any of your medical bills or any damage to your car. To get coverage for your vehicle, you must add collision and comprehensive coverage. However, suppose you are focused on finding the cheapest car insurance for liability only. In that case, this basic policy will satisfy the law and protect your assets from claims made by others.

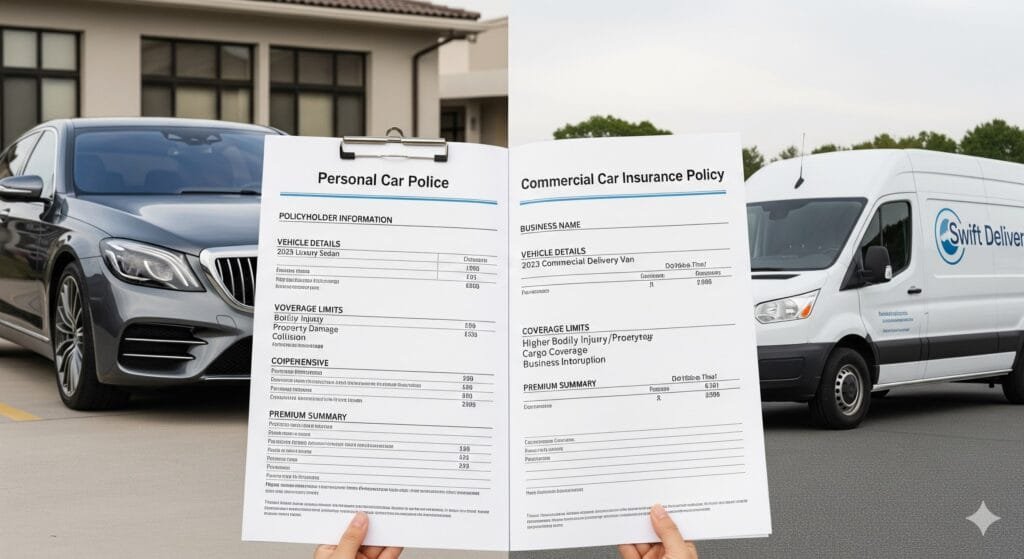

Commercial vs. Personal Car Insurance: What’s the Difference?

Using your vehicle for work purposes can change your insurance needs. A standard personal auto policy may not cover you if you get into an accident while driving for business. This is where commercial auto insurance comes in.

When Do You Need Commercial Car Insurance?

You likely need commercial car insurance if you use your vehicle for activities such as:

- Transporting goods or people for a fee (like a delivery driver or rideshare driver).

- Towing heavy work-related equipment.

- Driving to and from multiple job sites throughout the day.

- If a business or corporation owns your vehicle.

Commercial policies typically offer higher liability limits and provide coverage for employees who may be driving the vehicle.

Is Commercial Car Insurance Cheaper Than Personal?

Many people wonder, “Is commercial car insurance cheaper than personal?” or “Is business car insurance cheaper than personal?” The answer is typically no. Commercial auto insurance is usually more expensive than a personal policy. This is because business vehicles often spend more time on the road, carry valuable equipment, and have a higher risk of accidents.

However, the cost can vary greatly depending on the type of business, the vehicle, and the driving records of the employees. The only way to know for sure is to get quotes for both types of policies and see what makes the most sense for your situation. Trying to save money by using a personal policy for business use is a risky gamble that could leave you with no coverage when you need it most.